Net income, a crucial metric for assessing a company’s profitability, is calculated by subtracting total expenses from total revenues. Understanding How Do You Calculate Net Income In Accounting is essential for strategic partnerships and boosting revenue, which is where income-partners.net comes in. This calculation provides a clear picture of a business’s financial health, guiding investment decisions and operational adjustments. Explore collaboration avenues at income-partners.net for lucrative ventures, enhanced earnings, and robust bottom-line performance.

Table of Contents

- What is Net Income and Why is it Important?

- The Net Income Formula: A Step-by-Step Guide

- Net Income vs. Gross Income: Understanding the Difference

- Operating Income and Its Relationship with Net Income

- How to Calculate Operating Net Income

- Net Income on the Income Statement: A Detailed Look

- Real-World Examples of Net Income Calculation

- The Impact of Net Income on Business Decisions

- Utilizing Net Income for Financial Analysis

- Strategies to Improve Your Net Income

- Common Mistakes to Avoid When Calculating Net Income

- The Role of Bookkeeping in Accurate Net Income Calculation

- Net Income and Its Significance for Investors

- How Net Income Affects Your Creditworthiness

- The Future of Net Income Analysis in Business

- FAQ: Understanding Net Income in Detail

1. What is Net Income and Why is it Important?

Net income, often referred to as “net profit,” “net earnings,” or simply “profit,” represents a company’s profitability after all expenses have been deducted from total revenue. It’s the bottom line, the figure that reveals whether a business has made a profit or incurred a loss during a specific period. Why is this number so important? Because it is a key indicator of a company’s financial health and operational efficiency. Income-partners.net understands the critical role net income plays in attracting strategic partners, driving revenue growth, and ensuring long-term sustainability.

Think of it this way: if a business is “in the red,” it means they have a net loss. Conversely, if they’re “in the black,” they have a net income. Historically, accountants used red ink to record net losses and black ink for net income, hence these colorful terms.

Red Ink and Black Ink

Red Ink and Black Ink

Why is Net Income Important?

- Financial Health: Net income offers a clear snapshot of your business’s financial condition. Consistently increasing net income suggests that your business strategies are effective, and your operations are efficient. Conversely, a declining net income may signal the need for cost-cutting measures or strategic adjustments.

- Attracting Investors: Investors closely monitor net income to gauge a company’s profitability and potential for returns. A healthy net income can attract investors looking for businesses with the capacity to generate dividends, reinvest in growth, or build reserves for future needs.

- Securing Loans: Lenders use net income to assess a company’s ability to repay debts. A robust net income increases the likelihood of securing favorable loan terms, as it demonstrates the business’s financial stability and capacity to meet its obligations.

- Strategic Decision-Making: Net income serves as a critical benchmark for making informed business decisions. Whether it’s evaluating the profitability of a new product line, assessing the effectiveness of marketing campaigns, or deciding on capital investments, net income provides the insights needed to drive strategic growth.

- Performance Measurement: Net income allows you to track your business’s performance over time. By comparing net income across different periods, you can identify trends, evaluate the impact of operational changes, and measure progress toward financial goals.

According to research from the University of Texas at Austin’s McCombs School of Business, consistently tracking and analyzing net income is crucial for maintaining financial stability and attracting strategic partners.

By understanding the significance of net income, businesses can make better-informed decisions, attract investment, and ensure long-term financial health. For more insights and partnership opportunities, visit income-partners.net.

2. The Net Income Formula: A Step-by-Step Guide

So, how do you calculate net income in accounting? The net income formula is quite straightforward, yet understanding each component is essential for accurate financial analysis. Net income is essentially your company’s total profits after all business expenses have been deducted. It’s what remains after you’ve accounted for everything, providing a clear picture of your company’s financial performance.

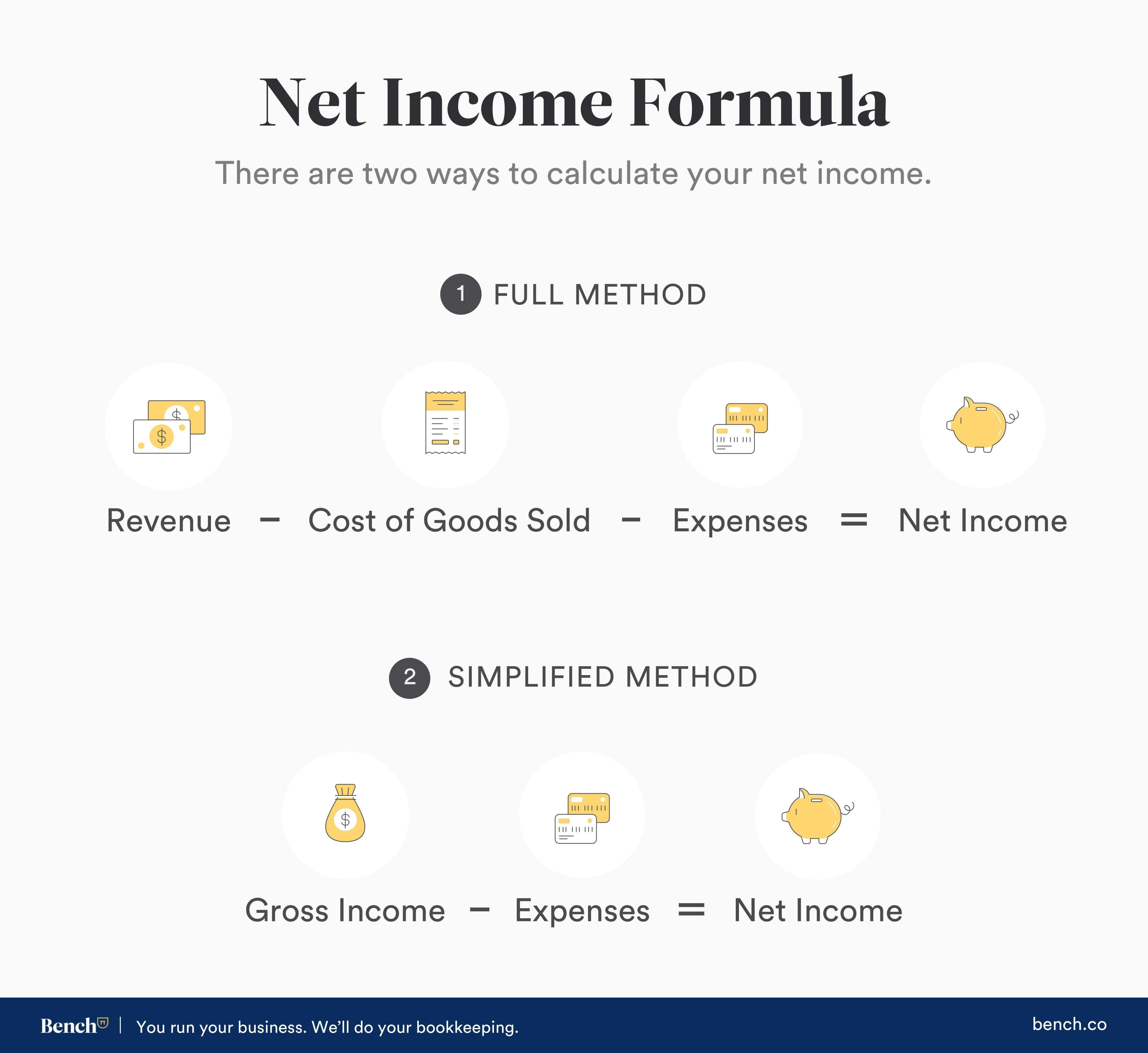

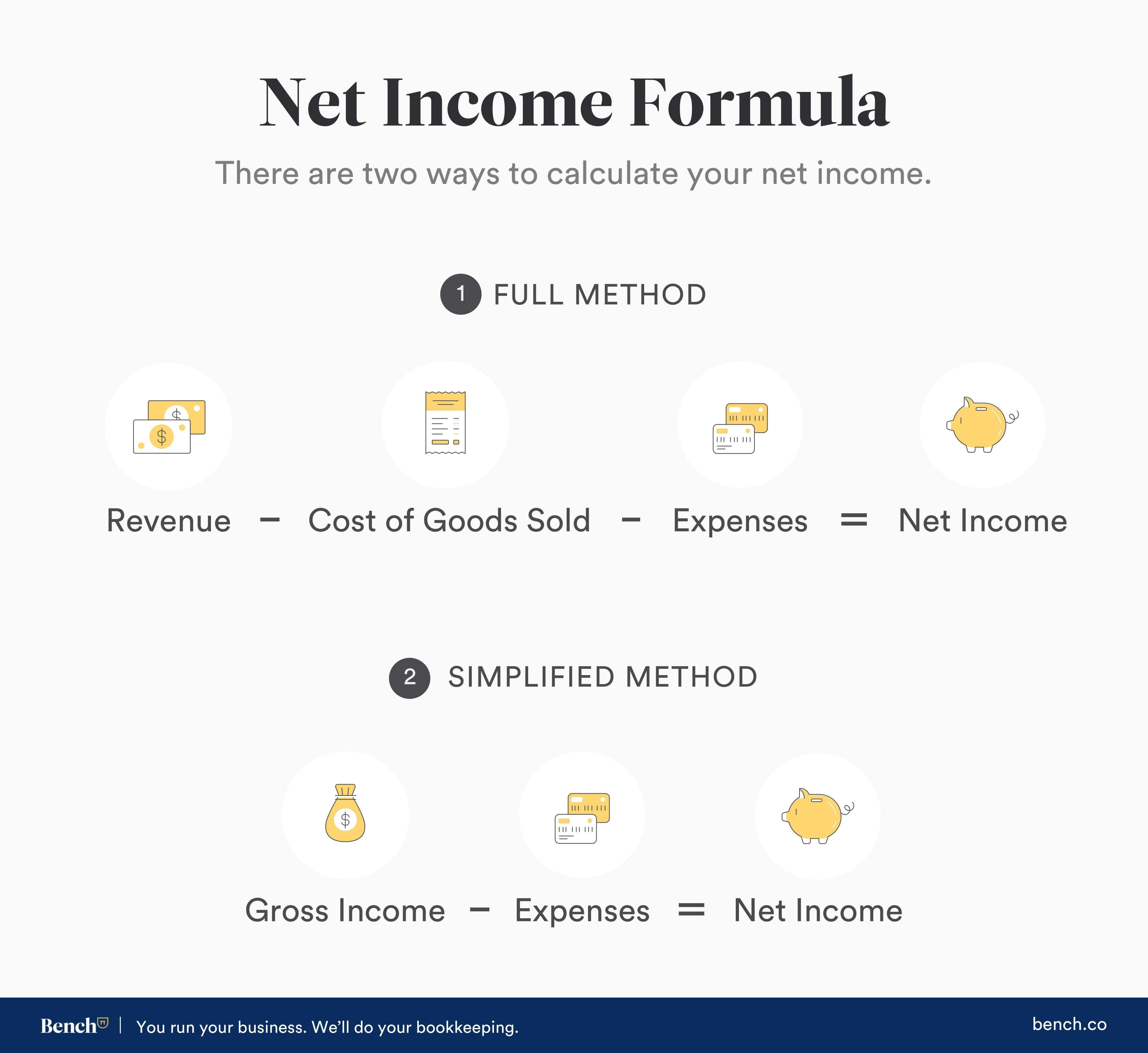

The basic formula for calculating net income is:

Revenue – Cost of Goods Sold (COGS) – Expenses = Net Income

Alternatively, you can express it as:

Gross Income – Expenses = Net Income

Or, in its simplest form:

Total Revenues – Total Expenses = Net Income

Breaking Down the Formula

- Revenue: This is the total amount of money your company brings in from sales of products or services. It’s often referred to as gross revenue or sales revenue.

- Cost of Goods Sold (COGS): COGS includes the direct costs associated with producing the goods or services you sell. This can include raw materials, labor, and other direct expenses.

- Gross Income: This is calculated by subtracting COGS from your total revenue. It represents the profit you make before accounting for operating expenses.

- Expenses: This encompasses all other costs incurred in running your business, such as rent, utilities, salaries, marketing, interest payments, and depreciation.

Step-by-Step Calculation

Let’s walk through a detailed example to illustrate how to calculate net income in accounting using the formula.

Step 1: Calculate Total Revenue

Start by determining your total revenue for the period. This is the total income generated from your primary business activities, such as sales of products or services.

Example:

Suppose “Tech Solutions Inc.” generated $500,000 in revenue from its software sales during the fiscal year.

Total Revenue: $500,000

Step 2: Determine Cost of Goods Sold (COGS)

COGS includes all direct costs associated with producing the goods or services sold. This might include raw materials, direct labor, and other directly related costs.

Example:

Tech Solutions Inc. spent $150,000 on direct labor and materials to produce its software.

Cost of Goods Sold (COGS): $150,000

Step 3: Calculate Gross Income

Gross income is calculated by subtracting COGS from the total revenue. It represents the income available to cover operating expenses.

Formula: Gross Income = Total Revenue – Cost of Goods Sold

Calculation: Gross Income = $500,000 – $150,000 = $350,000

Gross Income: $350,000

Step 4: Identify Operating Expenses

Operating expenses are the costs incurred to run the business but are not directly related to the production of goods or services. These include salaries, rent, utilities, marketing, and administrative costs.

Example:

Tech Solutions Inc. had the following operating expenses:

- Salaries: $80,000

- Rent: $20,000

- Utilities: $5,000

- Marketing: $15,000

- Administrative Costs: $10,000

Total Operating Expenses: $80,000 + $20,000 + $5,000 + $15,000 + $10,000 = $130,000

Step 5: Include Other Expenses and Income

This category includes expenses and income not directly related to the company’s primary operating activities, such as interest expense, interest income, gains from the sale of assets, and losses from lawsuits.

Example:

Tech Solutions Inc. had the following additional items:

- Interest Expense: $2,000

- Interest Income: $1,000

- Loss from Lawsuit: $3,000

Net Other Expenses: $2,000 (Interest Expense) + $3,000 (Loss from Lawsuit) – $1,000 (Interest Income) = $4,000

Step 6: Calculate Earnings Before Tax (EBT)

Earnings Before Tax (EBT) is calculated by subtracting total operating expenses and net other expenses from the gross income.

Formula: EBT = Gross Income – Total Operating Expenses – Net Other Expenses

Calculation: EBT = $350,000 – $130,000 – $4,000 = $216,000

Earnings Before Tax (EBT): $216,000

Step 7: Account for Income Tax Expense

Income tax expense is the amount a company owes in taxes based on its taxable income.

Example:

Tech Solutions Inc. has an income tax expense of $60,000.

Income Tax Expense: $60,000

Step 8: Calculate Net Income

Net income is the final profit after deducting all expenses, including income taxes, from the total revenue.

Formula: Net Income = Earnings Before Tax (EBT) – Income Tax Expense

Calculation: Net Income = $216,000 – $60,000 = $156,000

Net Income: $156,000

In this example, Tech Solutions Inc. has a net income of $156,000 for the fiscal year. This means that after covering all its expenses, including the cost of goods sold, operating expenses, interest, and taxes, the company made a profit of $156,000. This figure is a critical indicator of the company’s profitability and financial health.

Positive vs. Negative Net Income

Net income can be either positive or negative. A positive net income indicates that your company has more revenues than expenses, signifying a profit. Conversely, a negative net income, also known as a net loss, means that your total expenses exceed your revenues.

Periodicity

You can calculate net income for any given period, whether it’s annual, quarterly, or monthly—whichever timeframe aligns with your business’s needs and reporting requirements.

Benefits of Understanding the Net Income Formula

- Accurate Financial Reporting: Knowing how to calculate net income ensures that your financial reports are accurate and reliable.

- Informed Decision-Making: Understanding the formula allows you to make informed decisions about pricing, cost control, and investments.

- Investor Confidence: Presenting a clear and accurate net income figure can boost investor confidence in your business.

- Strategic Planning: Net income serves as a foundation for strategic planning, helping you set realistic financial goals and develop strategies to achieve them.

By mastering the net income formula, businesses can gain valuable insights into their financial performance and make strategic adjustments to improve profitability. Income-partners.net offers additional resources and partnership opportunities to help businesses optimize their revenue and reduce expenses, leading to a healthier net income.

3. Net Income vs. Gross Income: Understanding the Difference

When diving into financial analysis, it’s easy to mix up various income metrics. Two of the most commonly confused terms are net income and gross income. While both are crucial indicators of financial performance, they represent different stages of profitability. Let’s break down the key differences between net income and gross income to provide clarity.

Gross Income Explained

Gross income, also known as gross profit or gross earnings, is your revenue minus the cost of goods sold (COGS). COGS includes the direct expenses involved in producing your products or services.

The formula for gross income is:

Gross Income = Revenue – Cost of Goods Sold (COGS)

Where:

- Revenue: The total amount of money your company earns from sales.

- Cost of Goods Sold (COGS): The direct costs associated with producing goods or services.

Red Ink and Black Ink

Red Ink and Black Ink

Examples of COGS:

- Raw materials

- Direct labor

- Packaging

- Freight and shipping

- Energy and utility expenses for a production facility

- Depreciation expenses on production equipment and machinery

It’s important to note that COGS does not include indirect expenses, also known as overhead or operating expenses. These include salaries for management, administrative expenses, utilities for office spaces, insurance, and interest.

Net Income Explained

Net income, on the other hand, is your company’s total profit after deducting all business expenses, including both direct and indirect costs, from your total revenue. It’s the “bottom line” figure that appears at the end of your income statement.

The formula for net income is:

Net Income = Revenue – Cost of Goods Sold – Operating Expenses – Interest – Taxes

Alternatively, it can be simplified as:

Net Income = Gross Income – Operating Expenses – Interest – Taxes

Key Differences Summarized

To better illustrate the differences, let’s summarize the key points in a table:

| Feature | Gross Income | Net Income |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Revenue minus all expenses (COGS, operating expenses, interest, taxes) |

| Formula | Revenue – COGS | Gross Income – Operating Expenses – Interest – Taxes or Total Revenue – Total Expenses |

| Expenses Included | Direct costs (raw materials, direct labor) | All costs (direct, indirect, operating, interest, taxes) |

| Position on Income Statement | Higher up, closer to revenue | Bottom line, at the very end |

| Usefulness | Measures production efficiency | Measures overall profitability |

Example Scenario

Consider a small bakery, “Sweet Delights,” with the following financials:

- Revenue: $200,000

- Cost of Goods Sold (COGS): $80,000 (includes ingredients and direct labor)

- Operating Expenses: $50,000 (includes rent, utilities, salaries of administrative staff)

- Interest Expense: $5,000

- Taxes: $10,000

Calculating Gross Income:

Gross Income = Revenue – COGS

Gross Income = $200,000 – $80,000 = $120,000

Calculating Net Income:

Net Income = Gross Income – Operating Expenses – Interest – Taxes

Net Income = $120,000 – $50,000 – $5,000 – $10,000 = $55,000

In this example, Sweet Delights has a gross income of $120,000 and a net income of $55,000. The gross income provides insight into the profitability of their baked goods, while the net income reflects the overall financial health of the business after all expenses are accounted for.

Why Both Metrics Matter

- Gross Income: This metric is useful for assessing how efficiently a company produces its goods or services. It helps in evaluating pricing strategies and managing direct costs.

- Net Income: This is the ultimate measure of a company’s profitability. It takes into account all expenses and provides a comprehensive view of financial performance. Investors and lenders often focus on net income to determine the financial health and sustainability of a business.

Understanding the difference between gross income and net income is essential for accurate financial analysis. While gross income provides a snapshot of production efficiency, net income offers a complete picture of overall profitability. Businesses should monitor both metrics to make informed decisions and attract strategic partners. For more insights and partnership opportunities, visit income-partners.net.

4. Operating Income and Its Relationship with Net Income

To further refine our understanding of profitability, it’s essential to explore operating income and its relationship with net income. Operating income provides another layer of insight into a company’s financial performance by focusing specifically on profits generated from core business operations.

What is Operating Income?

Operating income, sometimes referred to as earnings before interest and taxes (EBIT), is a measure of a company’s profitability from its core operations. It excludes non-operating items such as interest income, interest expense, and taxes. By focusing on operational performance, operating income helps investors and analysts assess how efficiently a company generates profits from its primary business activities.

The Formula for Operating Income

The formula for operating income is:

Operating Income = Gross Income – Operating Expenses

Where:

- Gross Income: Revenue minus the cost of goods sold (COGS).

- Operating Expenses: Costs incurred in running the business, excluding COGS, interest, and taxes. These typically include selling, general, and administrative (SG&A) expenses.

Components of Operating Expenses

Operating expenses encompass a wide range of costs necessary to run a business, such as:

- Salaries and wages

- Rent

- Utilities

- Marketing and advertising

- Research and development

- Depreciation and amortization

- Administrative expenses

How Operating Income Differs from Net Income

While both operating income and net income are measures of profitability, they differ in scope. Operating income focuses solely on the profitability of a company’s core operations, excluding the impact of interest, taxes, and other non-operating items. Net income, on the other hand, provides a comprehensive view of overall profitability by including all revenues and expenses, regardless of their source.

To illustrate the relationship, let’s look at the formulas side by side:

- Operating Income = Gross Income – Operating Expenses

- Net Income = Operating Income – Interest – Taxes + Non-Operating Income – Non-Operating Expenses

From these formulas, we can see that net income builds upon operating income by incorporating financial and tax-related items.

Why Operating Income Matters

- Focus on Core Operations: Operating income provides a clear picture of how well a company is performing in its primary business activities, without the distortion of financial or tax-related items.

- Comparison Across Companies: Operating income allows for easier comparison of profitability between companies, especially those in different tax jurisdictions or with varying levels of debt.

- Internal Performance Assessment: Management can use operating income to evaluate the efficiency of their operational strategies and identify areas for improvement.

- Predictive Power: Because it excludes non-operating items, operating income can be a more reliable predictor of future earnings potential from core business activities.

Example Scenario

Consider a manufacturing company, “PrecisionTech,” with the following financial data:

- Revenue: $1,500,000

- Cost of Goods Sold (COGS): $700,000

- Operating Expenses: $400,000 (includes salaries, rent, utilities, and marketing)

- Interest Expense: $50,000

- Taxes: $100,000

- Non-Operating Income (Gain from Sale of Equipment): $20,000

Calculating Gross Income:

Gross Income = Revenue – COGS

Gross Income = $1,500,000 – $700,000 = $800,000

Calculating Operating Income:

Operating Income = Gross Income – Operating Expenses

Operating Income = $800,000 – $400,000 = $400,000

Calculating Net Income:

Net Income = Operating Income – Interest – Taxes + Non-Operating Income

Net Income = $400,000 – $50,000 – $100,000 + $20,000 = $270,000

In this example, PrecisionTech has an operating income of $400,000 and a net income of $270,000. The operating income highlights the profitability of its manufacturing operations, while the net income reflects the company’s overall profitability after accounting for interest, taxes, and the gain from the sale of equipment.

Interpreting the Results

- High Operating Income: Indicates that the company is efficiently managing its core business operations and generating substantial profits from its primary activities.

- Low Operating Income: May suggest inefficiencies in operations, high operating expenses, or pricing issues that need to be addressed.

- Difference Between Operating and Net Income: A significant difference between operating income and net income may indicate the impact of financial leverage (interest expense) or one-time events (non-operating income).

Understanding the relationship between operating income and net income provides a more comprehensive view of a company’s financial health. By analyzing both metrics, businesses can gain deeper insights into their operational efficiency and overall profitability. For more insights and partnership opportunities, visit income-partners.net.

5. How to Calculate Operating Net Income

Operating net income is a refined metric that helps businesses and investors understand the profitability of a company’s core operations, independent of financial and tax impacts. This measure is particularly useful for comparing companies with different capital structures or tax environments. Here’s how to calculate operating net income, along with an example to illustrate the process.

What is Operating Net Income?

Operating net income, also known as operating profit after tax (OPAT), measures the profit a company generates from its core business activities after accounting for operating expenses and taxes directly related to operations. Unlike net income, operating net income excludes interest income, interest expense, and other non-operating items. This provides a clearer view of how efficiently a company’s operations are performing.

Formula for Operating Net Income

There are two primary formulas to calculate operating net income:

Formula 1: Starting with Net Income

Operating Net Income = Net Income + Interest Expense (1 – Tax Rate) – Interest Income (1 – Tax Rate) + Non-Operating Losses (1 – Tax Rate) – Non-Operating Gains (1 – Tax Rate)

Formula 2: Starting with Earnings Before Interest and Taxes (EBIT)

Operating Net Income = EBIT * (1 – Tax Rate)

Where:

- Net Income: The company’s profit after all expenses, interest, and taxes are deducted.

- Interest Expense: The cost of borrowing money.

- Interest Income: The income earned from investments or savings.

- Tax Rate: The company’s effective tax rate.

- EBIT (Earnings Before Interest and Taxes): Revenue minus cost of goods sold and operating expenses.

- Non-Operating Losses: Losses from activities outside the company’s core operations.

- Non-Operating Gains: Gains from activities outside the company’s core operations.

Steps to Calculate Operating Net Income

Let’s break down the steps using both formulas to ensure a comprehensive understanding.

Step 1: Gather Financial Information

Collect the necessary financial data from the company’s income statement, including:

- Net Income

- Interest Expense

- Interest Income

- Tax Rate

- EBIT

- Non-Operating Losses

- Non-Operating Gains

Step 2: Calculate Using Formula 1 (Starting with Net Income)

-

Adjust Interest Expense and Income for Tax:

- Calculate the after-tax interest expense: Interest Expense * (1 – Tax Rate)

- Calculate the after-tax interest income: Interest Income * (1 – Tax Rate)

-

Adjust Non-Operating Losses and Gains for Tax

- Calculate the after-tax non-operating losses: Non-Operating Losses * (1 – Tax Rate)

- Calculate the after-tax non-operating gains: Non-Operating Gains * (1 – Tax Rate)

-

Apply the Formula:

- Operating Net Income = Net Income + After-Tax Interest Expense – After-Tax Interest Income + After-Tax Non-Operating Losses – After-Tax Non-Operating Gains

Step 3: Calculate Using Formula 2 (Starting with EBIT)

-

Determine EBIT:

- EBIT = Revenue – Cost of Goods Sold – Operating Expenses

-

Apply the Formula:

- Operating Net Income = EBIT * (1 – Tax Rate)

Example Scenario

Consider “GreenTech Solutions,” a technology company with the following financials:

- Revenue: $2,000,000

- Cost of Goods Sold (COGS): $800,000

- Operating Expenses: $500,000

- Net Income: $420,000

- Interest Expense: $30,000

- Interest Income: $10,000

- Tax Rate: 25% (0.25)

- Non-Operating Losses: $5,000

- Non-Operating Gains: $2,000

Calculation Using Formula 1 (Starting with Net Income)

-

After-Tax Interest Expense:

- Interest Expense (1 – Tax Rate) = $30,000 (1 – 0.25) = $30,000 * 0.75 = $22,500

-

After-Tax Interest Income:

- Interest Income (1 – Tax Rate) = $10,000 (1 – 0.25) = $10,000 * 0.75 = $7,500

-

After-Tax Non-Operating Losses:

- Non-Operating Losses (1 – Tax Rate) = $5,000 (1 – 0.25) = $5,000 * 0.75 = $3,750

-

After-Tax Non-Operating Gains:

- Non-Operating Gains (1 – Tax Rate) = $2,000 (1 – 0.25) = $2,000 * 0.75 = $1,500

-

Operating Net Income:

- Operating Net Income = Net Income + After-Tax Interest Expense – After-Tax Interest Income + After-Tax Non-Operating Losses – After-Tax Non-Operating Gains

- Operating Net Income = $420,000 + $22,500 – $7,500 + $3,750 – $1,500 = $437,250

Calculation Using Formula 2 (Starting with EBIT)

-

Calculate EBIT:

- EBIT = Revenue – COGS – Operating Expenses

- EBIT = $2,000,000 – $800,000 – $500,000 = $700,000

-

Operating Net Income:

- Operating Net Income = EBIT * (1 – Tax Rate)

- Operating Net Income = $700,000 (1 – 0.25) = $700,000 0.75 = $437,500

Interpreting the Results

In this example, using both formulas, GreenTech Solutions has an operating net income of approximately $437,250. This indicates the profit generated strictly from its core technology operations, excluding the effects of financing decisions and non-core activities.

Benefits of Using Operating Net Income

- Clear View of Operational Efficiency: Provides a focused measure of how well the company’s core operations are performing.

- Comparison Across Companies: Facilitates easier comparison of companies with different capital structures or tax situations.

- Internal Performance Assessment: Helps management evaluate the effectiveness of operational strategies and identify areas for improvement.

- Investment Decisions: Informs investors about the sustainable profitability of the company’s primary business.

Understanding how to calculate operating net income is crucial for businesses aiming to assess their true operational profitability. By excluding financial and tax-related distortions, this metric provides a clearer picture of core business performance. For more insights and partnership opportunities to enhance your business’s financial health, visit income-partners.net.

6. Net Income on the Income Statement: A Detailed Look

The income statement, also known as the profit and loss (P&L) statement, is a critical financial report that summarizes a company’s financial performance over a specific period. Net income is a key line item on this statement, representing the final profit or loss after all revenues and expenses have been accounted for. Understanding how net income is presented on the income statement is essential for financial analysis and decision-making.

Structure of the Income Statement

The income statement typically follows a multi-step format, starting with revenue and progressively deducting various costs and expenses to arrive at net income. The basic structure includes the following components:

- Revenue: The total amount of money earned from the sale of goods or services during the reporting period.

- Cost of Goods Sold (COGS): The direct costs associated with producing and selling goods or services.

- Gross Profit: Calculated by subtracting COGS from revenue (Revenue – COGS). It represents the profit earned before considering operating expenses.

- Operating Expenses: Expenses incurred in running the business, such as salaries, rent, utilities, marketing, and administrative costs.

- Operating Income: Calculated by subtracting operating expenses from gross profit (Gross Profit – Operating Expenses). It measures the profitability of the company’s core operations.

- Other Income and Expenses: Includes non-operating items such as interest income, interest expense, gains or losses from the sale of assets, and other miscellaneous items.

- Earnings Before Tax (EBT): Calculated by adding other income and subtracting other expenses from operating income.

- Income Tax Expense: The amount of income taxes owed based on the company’s taxable income.

- Net Income: The final profit or loss after deducting all expenses, including income taxes, from total revenue (EBT – Income Tax Expense).

Detailed Breakdown of Key Sections

Let’s delve deeper into each section of the income statement to understand how net income is derived.

1. Revenue

Revenue represents the total income generated from the company’s primary business activities. It is the starting point for calculating net income.

- Example: For a retail company, revenue would be the total sales from merchandise. For a service-based company, it would be the total fees earned from providing services.

2. Cost of Goods Sold (COGS)

COGS includes the direct costs associated with producing and selling goods or services. This can include:

- Raw materials

- Direct labor

- Manufacturing overhead

- Freight and shipping

Subtracting COGS from revenue provides the gross profit, which is a measure of how efficiently a company produces its goods or services.

3. Gross Profit

Gross Profit = Revenue – Cost of Goods Sold

This metric is useful for assessing the profitability of each product or service and for comparing production efficiency across different periods or companies.

4. Operating Expenses

Operating expenses are the costs incurred to run the business and support its operations. These expenses are typically categorized into:

- Selling Expenses: Costs related to marketing, advertising, and selling products or services.

- General and Administrative Expenses: Costs related to managing the company, such as salaries, rent, utilities, and office supplies.

- Research and Development (R&D) Expenses: Costs related to developing new products or improving existing ones.

5. Operating Income

Operating Income = Gross Profit – Operating Expenses

Operating income measures the profitability of a company’s core operations, excluding the effects of financial and tax-related items. It is a key indicator of operational efficiency and performance.

6. Other Income and Expenses

This section includes items that are not directly related to the company’s primary business activities, such as:

- Interest Income: Income earned from investments or savings accounts.

- Interest Expense: The cost of borrowing money.

- Gains or Losses from the Sale of Assets: Profit or loss from selling equipment, property, or investments.

- Miscellaneous Income or Expenses: Any other non-operating income or expenses.

7. Earnings Before Tax (EBT)

Earnings Before Tax (EBT) = Operating Income + Other Income – Other Expenses

EBT represents the company’s profit before considering income taxes. It is an important metric for assessing overall profitability before the impact of taxation.

8. Income Tax Expense

Income tax expense is the amount of taxes a company owes based on its taxable income. It is determined by applying the applicable tax rate to the company’s taxable income.

9. Net Income

Net Income = Earnings Before Tax (EBT) – Income Tax Expense

Net income is the final “bottom line” figure on the income statement, representing the company’s profit or loss after all revenues and expenses have been accounted for. It is a comprehensive measure of overall financial performance.

Example of an Income Statement

Here is an example of a simplified income statement for “Tech Solutions Inc.” for the year ended December 31, 2023:

| Item | Amount |

|---|---|

| Revenue | $2,000,000 |

| Cost of Goods Sold (COGS) | $800,000 |

| Gross Profit | $1,200,000 |

| Operating Expenses | $500,000 |

| Operating Income | $700,000 |

| Interest Income | $10,000 |

| Interest Expense | ($30,000) |

| Earnings Before Tax (EBT) | $680,000 |

| Income Tax Expense | ($170,000) |

| Net Income | $510,000 |

In this example, Tech Solutions Inc. has a net income of $510,000 for the year ended December 31, 2023. This means that after covering all its expenses, including the cost of goods sold, operating expenses, interest, and taxes, the company made a profit of $510,000.

Importance of Net Income on the Income Statement

Net income is a critical metric for several reasons:

- Performance Evaluation: It provides a comprehensive measure of a company’s financial performance over a specific period.

- Decision-Making: It informs decisions related to investments, cost control, pricing, and strategic planning.

- Investor Confidence: It is a key indicator used by investors and analysts to assess a company’s profitability and financial health.

- Creditworthiness: Lenders use net income to assess a company’