How To Figure Net Income In Accounting is a crucial question for business owners, investors, and anyone seeking to understand a company’s financial health. Net income, also known as net profit or net earnings, represents a company’s profitability after all expenses have been deducted from revenue, and income-partners.net can guide you through partnering for increased profitability. This comprehensive guide provides a clear and actionable approach to mastering net income calculation, offering strategies for financial collaboration and mutual growth.

1. What is Net Income and Why is it Important?

Net income is a fundamental concept in accounting, representing the profit a company makes after deducting all expenses from its total revenue. Understanding how to calculate net income is essential for evaluating a company’s financial performance and making informed business decisions.

1.1. Net Income Defined

Net income is the bottom line on a company’s income statement, representing the actual profit earned during a specific period, such as a month, quarter, or year. According to research from the University of Texas at Austin’s McCombs School of Business, in July 2025, a positive net income indicates profitability, while a negative net income signifies a net loss.

1.2. Why Net Income Matters

Net income is a critical metric for several reasons:

- Financial Health Indicator: It provides a clear picture of a company’s profitability and overall financial well-being.

- Investment Decisions: Investors use net income to assess a company’s ability to generate profits and provide returns.

- Lender Evaluation: Lenders analyze net income to determine a company’s ability to repay debts.

- Internal Performance Tracking: Businesses use net income to monitor their own performance and identify areas for improvement.

- Strategic Planning: Net income data helps in making informed decisions about pricing, cost management, and investment strategies.

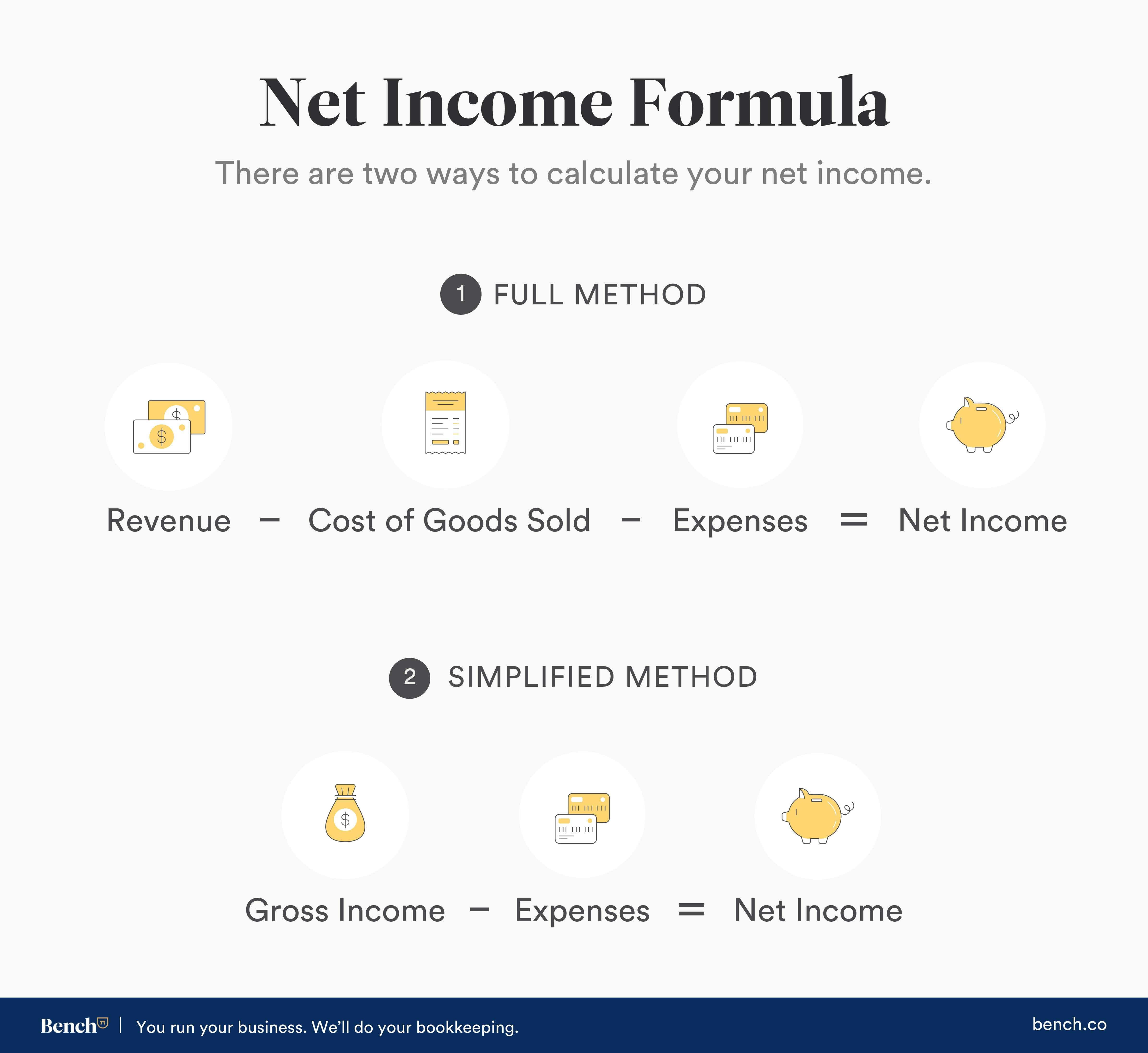

2. The Net Income Formula: A Step-by-Step Guide

The basic formula for calculating net income is straightforward:

Net Income = Total Revenue – Total Expenses

However, understanding the components of this formula and how they interact is crucial for accurate calculation.

2.1. Breaking Down the Formula

Let’s break down the net income formula into its key components:

- Total Revenue: This is the total amount of money a company earns from its sales of goods or services during a specific period.

- Cost of Goods Sold (COGS): This includes the direct costs associated with producing goods or services, such as raw materials, labor, and manufacturing overhead.

- Gross Profit: This is calculated by subtracting COGS from total revenue (Gross Profit = Total Revenue – COGS).

- Operating Expenses: These are the expenses incurred in running the business, such as salaries, rent, utilities, marketing, and administrative costs.

- Other Income and Expenses: This category includes income and expenses not directly related to the core business operations, such as interest income, interest expense, and gains or losses from the sale of assets.

- Income Tax Expense: This is the amount of income tax a company owes to the government based on its taxable income.

2.2. The Detailed Net Income Formula

A more detailed version of the net income formula is:

Net Income = (Total Revenue – COGS) – Operating Expenses + Other Income – Other Expenses – Income Tax Expense

2.3. Example Calculation

Let’s illustrate the net income calculation with an example:

| Item | Amount |

|---|---|

| Total Revenue | $500,000 |

| Cost of Goods Sold (COGS) | $200,000 |

| Gross Profit | $300,000 |

| Operating Expenses | $100,000 |

| Other Income | $10,000 |

| Other Expenses | $5,000 |

| Income Tax Expense | $50,000 |

| Net Income | $155,000 |

In this example, the company’s net income is $155,000.

Net income formula infographic

Net income formula infographic

3. Understanding Gross Profit vs. Net Income

It’s important to distinguish between gross profit and net income, as they represent different stages of profitability.

3.1. Gross Profit Explained

Gross profit is the profit a company makes after deducting the cost of goods sold (COGS) from its total revenue. It represents the profit earned from the core business activities before considering operating expenses, interest, and taxes.

Gross Profit = Total Revenue – COGS

3.2. Net Income: The Bottom Line

Net income, on the other hand, is the profit a company makes after deducting all expenses, including COGS, operating expenses, interest, and taxes. It represents the true profitability of the company after all costs have been accounted for.

Net Income = Gross Profit – Operating Expenses – Interest – Taxes

3.3. Why Both Metrics Matter

Both gross profit and net income are important metrics for different reasons. Gross profit provides insights into the efficiency of a company’s production process and its ability to control direct costs. Net income, however, provides a more comprehensive view of the company’s overall profitability and financial performance.

4. Operating Income: A Key Profitability Metric

Operating income is another important profitability metric that falls between gross profit and net income. It represents the profit a company makes from its core business operations before considering interest and taxes.

4.1. Operating Income Defined

Operating income, also known as earnings before interest and taxes (EBIT), is calculated by subtracting operating expenses from gross profit.

Operating Income = Gross Profit – Operating Expenses

4.2. Why Operating Income Matters

Operating income provides a clearer picture of a company’s profitability from its core business activities, as it excludes the impact of financing decisions (interest) and government regulations (taxes). This metric is particularly useful for comparing the performance of companies in different industries or with different capital structures.

4.3. The Relationship Between Gross Profit, Operating Income, and Net Income

The relationship between gross profit, operating income, and net income can be summarized as follows:

- Gross Profit: Revenue less the cost of goods sold.

- Operating Income: Gross profit less operating expenses.

- Net Income: Operating income less interest and taxes.

Each metric provides a different perspective on a company’s profitability, with net income offering the most comprehensive view.

5. Calculating Operating Net Income

Operating net income focuses on the profitability of a company’s core operations, excluding non-operating items.

5.1. What is Operating Net Income?

Operating net income is similar to net income but isolates profits from the primary activities of the business. This means it does not consider income and expenses unrelated to the core business, such as income tax, interest expense, interest income, and gains or losses from sales of fixed assets. Operating income is sometimes referred to as EBIT, or earnings before interest and taxes.

5.2. The Formula for Operating Net Income

The formula for operating net income is:

Operating Net Income = Net Income + Interest Expense + Taxes

Alternatively, it can be calculated as:

Operating Net Income = Gross Profit – Operating Expenses – Depreciation – Amortization

5.3. Why Use Operating Net Income?

Investors and lenders often prefer to use operating net income because it provides a clearer picture of the profitability of a company’s core business activities. For example, if a company sells a valuable piece of machinery, the gain from that sale will be included in the company’s net income. While this might make the company appear to be doing well, the operating net income will show if the core operations are actually struggling.

5.4. Example of Operating Net Income Calculation

Consider Wyatt’s Saddle Shop. If Wyatt wants to calculate his operating net income for the first quarter of 2021, he could simply add back the interest expense to his net income.

$20,000 (Net Income) + $1,000 (Interest Expense) = $21,000 (Operating Net Income)

6. Net Income on the Income Statement

Net income is a crucial line item on a company’s income statement, providing a summary of its financial performance over a specific period.

6.1. The Income Statement Explained

The income statement, also known as the profit and loss (P&L) statement, is a financial report that summarizes a company’s revenues, expenses, and net income over a specific period. It provides a comprehensive view of the company’s profitability and financial performance.

6.2. Net Income as the Bottom Line

Net income is typically listed at the very bottom of the income statement, representing the final profit figure after all revenues and expenses have been accounted for.

6.3. Example Income Statement

Here’s an example of a simplified income statement:

| Item | Amount |

|---|---|

| Sales Revenue | $1,000,000 |

| Cost of Goods Sold (COGS) | $400,000 |

| Gross Profit | $600,000 |

| Operating Expenses: | |

| Salaries | $100,000 |

| Rent | $50,000 |

| Utilities | $10,000 |

| Marketing | $20,000 |

| Depreciation | $15,000 |

| Total Operating Expenses | $195,000 |

| Operating Income | $405,000 |

| Interest Expense | $20,000 |

| Income Tax Expense | $100,000 |

| Net Income | $285,000 |

In this example, the company’s net income is $285,000.

7. Strategies to Improve Net Income Through Partnerships

Improving net income often requires strategic partnerships that leverage resources, expand market reach, and optimize costs. Here are several strategies to consider:

7.1. Strategic Alliances

Forming alliances with complementary businesses can lead to increased revenues and reduced expenses. For instance, a marketing firm could partner with a software company to offer bundled services, attracting more clients and increasing overall revenue.

7.2. Joint Ventures

Entering into joint ventures allows companies to share resources, expertise, and risks. This can be particularly beneficial for entering new markets or developing innovative products. For example, two manufacturing companies might form a joint venture to produce a new line of eco-friendly products, sharing the costs of research, development, and marketing.

7.3. Distribution Partnerships

Partnering with established distributors can significantly expand a company’s market reach and increase sales. A small business producing artisanal goods could partner with a larger retailer to distribute its products nationwide, increasing revenue and brand awareness.

7.4. Supply Chain Optimization

Collaborating with suppliers to streamline the supply chain can lead to reduced costs and improved efficiency. Negotiating better pricing, optimizing logistics, and implementing just-in-time inventory management can all contribute to higher net income.

7.5. Co-Marketing Agreements

Engaging in co-marketing agreements with other businesses can help reach new customers and reduce marketing expenses. For example, a restaurant and a movie theater could partner to offer discounts to customers who visit both establishments, increasing traffic and revenue for both businesses.

7.6. Licensing Agreements

Licensing intellectual property or technology to other companies can generate additional revenue streams. A software company could license its technology to a hardware manufacturer, earning royalties and increasing net income without incurring significant additional costs.

7.7. Shared Services

Sharing services such as accounting, human resources, or IT with other businesses can reduce overhead costs. Several small businesses in the same industrial park could share an administrative office, reducing expenses and improving overall profitability.

7.8. Collaborative Research and Development

Partnering with research institutions or other companies to conduct research and development can reduce the costs and risks associated with innovation. This can lead to the development of new products or technologies that generate significant revenue.

7.9. Mergers and Acquisitions

In some cases, merging with or acquiring another company can lead to significant synergies and increased net income. Combining resources, eliminating redundancies, and expanding market share can result in higher profitability.

7.10. Referral Programs

Implementing referral programs with other businesses can generate new leads and increase sales. A real estate agent could partner with a mortgage broker to refer clients to each other, increasing their respective revenues.

7.11. Outsourcing

Outsourcing non-core activities to specialized partners can reduce costs and improve efficiency. A manufacturing company could outsource its customer service operations to a call center, reducing overhead and improving customer satisfaction.

7.12. Joint Purchasing Agreements

Collaborating with other businesses to negotiate better pricing on supplies and materials can lead to significant cost savings. Several restaurants could form a purchasing cooperative to buy food and beverages in bulk, reducing their expenses and improving their bottom line.

By carefully considering these strategies and selecting the partnerships that best align with their business goals, companies can significantly improve their net income and achieve sustainable growth. Income-partners.net can be a valuable resource in identifying and facilitating these strategic alliances.

8. Common Mistakes to Avoid When Calculating Net Income

Calculating net income accurately is crucial for making informed business decisions. Here are some common mistakes to avoid:

- Incorrect Revenue Recognition: Ensure that revenue is recognized only when it is earned and realizable, following accounting standards.

- Misclassifying Expenses: Properly categorize expenses as either cost of goods sold (COGS) or operating expenses.

- Ignoring Depreciation: Account for depreciation of assets over their useful lives.

- Forgetting Accrued Expenses: Include expenses that have been incurred but not yet paid.

- Overlooking Inventory Valuation: Use a consistent method for valuing inventory, such as FIFO or weighted average.

- Errors in Tax Calculation: Ensure accurate calculation of income tax expense based on applicable tax laws.

9. Using Technology to Streamline Net Income Calculation

Leveraging technology can significantly simplify and improve the accuracy of net income calculation.

9.1. Accounting Software

Accounting software like QuickBooks, Xero, and Sage automates many of the tasks involved in calculating net income, such as tracking revenue and expenses, generating financial statements, and reconciling bank accounts.

9.2. Spreadsheet Software

Spreadsheet software like Microsoft Excel and Google Sheets can be used to create custom templates for calculating net income and analyzing financial data.

9.3. Financial Reporting Tools

Financial reporting tools provide real-time insights into a company’s financial performance, allowing businesses to monitor their net income and identify trends.

10. Staying Compliant with Accounting Standards

Adhering to accounting standards is essential for ensuring the accuracy and reliability of financial statements.

10.1. Generally Accepted Accounting Principles (GAAP)

GAAP is a set of accounting standards and guidelines used in the United States.

10.2. International Financial Reporting Standards (IFRS)

IFRS is a set of accounting standards used in many countries around the world.

10.3. The Importance of Compliance

Compliance with accounting standards is crucial for maintaining the integrity of financial reporting and ensuring that financial statements are accurate and reliable.

11. Net Income and Taxes

Net income is a crucial figure when calculating taxes, as it forms the basis for determining taxable income.

11.1. Taxable Income

Taxable income is the amount of income that is subject to taxation. It is typically calculated by adjusting net income for certain deductions and exemptions.

11.2. Income Tax Expense

Income tax expense is the amount of income tax a company owes to the government based on its taxable income.

11.3. Tax Planning

Effective tax planning can help businesses minimize their tax liabilities and maximize their net income.

12. Forecasting Net Income

Forecasting net income is an important part of financial planning, allowing businesses to anticipate future performance and make informed decisions.

12.1. Forecasting Methods

There are several methods for forecasting net income, including:

- Trend Analysis: Analyzing past trends in revenue and expenses to project future performance.

- Regression Analysis: Using statistical techniques to identify relationships between variables and forecast net income.

- Budgeting: Creating a detailed budget that projects future revenue and expenses.

12.2. The Importance of Accurate Forecasting

Accurate net income forecasting is crucial for making informed decisions about investments, financing, and operations.

13. Seeking Professional Advice

Navigating the complexities of net income calculation and financial reporting can be challenging. Seeking professional advice from accountants, financial advisors, and business consultants can provide valuable insights and ensure accuracy.

13.1. The Role of Accountants

Accountants can help businesses with a wide range of financial tasks, including:

- Preparing financial statements

- Calculating net income

- Providing tax advice

- Auditing financial records

13.2. The Role of Financial Advisors

Financial advisors can help businesses with:

- Financial planning

- Investment management

- Risk management

14. Real-World Examples of Net Income Impact

Examining real-world examples can provide valuable insights into the impact of net income on business decisions and outcomes.

14.1. Case Study 1: Tech Startup Growth

A tech startup invests heavily in R&D, initially showing low net income. However, successful product launches lead to increased revenue and significant net income growth, attracting investors and fueling further expansion.

14.2. Case Study 2: Retail Chain Turnaround

A retail chain implements cost-cutting measures and improves inventory management, resulting in higher gross profit margins and increased net income. This turnaround allows the company to reinvest in store renovations and marketing, driving further growth.

14.3. Case Study 3: Manufacturing Efficiency

A manufacturing company streamlines its production processes and negotiates better pricing with suppliers, leading to lower COGS and higher net income. The increased profitability enables the company to invest in new equipment and expand its production capacity.

15. The Future of Net Income Analysis

The future of net income analysis is likely to be shaped by technological advancements and evolving business practices.

15.1. Artificial Intelligence (AI)

AI is being used to automate financial analysis, identify patterns, and predict future performance.

15.2. Big Data

Big data analytics provides businesses with access to vast amounts of financial and operational data, enabling them to make more informed decisions.

15.3. Blockchain Technology

Blockchain technology can improve the transparency and security of financial transactions, reducing the risk of fraud and errors.

16. Why Partner with Income-Partners.Net?

Income-partners.net offers a unique platform for businesses seeking strategic alliances to enhance their net income. Our platform connects you with potential partners who share your vision and can contribute to your financial success.

16.1. Comprehensive Partner Network

Access a diverse network of businesses across various industries, all seeking collaborative opportunities to drive revenue and reduce costs.

16.2. Customized Matching Algorithms

Our advanced algorithms match you with partners based on your specific business goals, industry, and financial objectives, ensuring a mutually beneficial relationship.

16.3. Expert Guidance and Support

Receive expert guidance and support from our team of business consultants, who can help you identify the best partnership opportunities and navigate the complexities of collaboration.

16.4. Proven Track Record

Benefit from our proven track record of connecting businesses and facilitating successful partnerships that drive significant improvements in net income.

17. Call to Action

Ready to unlock the potential of strategic partnerships and boost your net income? Visit income-partners.net today to explore our network of potential partners, discover innovative collaboration strategies, and connect with the resources you need to achieve your financial goals.

17.1. Explore Partnership Opportunities

Browse our comprehensive directory of businesses seeking strategic alliances and identify potential partners who align with your goals.

17.2. Learn Proven Strategies

Access our library of resources, including articles, case studies, and expert insights, to learn proven strategies for successful collaboration and net income enhancement.

17.3. Connect with Experts

Connect with our team of business consultants and financial advisors, who can provide personalized guidance and support to help you navigate the complexities of partnerships and financial management.

Take the first step towards a more profitable future. Visit income-partners.net now and discover the power of strategic partnerships.

18. Frequently Asked Questions (FAQs)

18.1. What is the difference between net income and revenue?

Net income is the profit a company makes after deducting all expenses from its total revenue, while revenue is the total amount of money a company earns from its sales of goods or services.

18.2. How often should I calculate net income?

Net income should be calculated at least monthly, quarterly, and annually to monitor financial performance and identify trends.

18.3. What is a good net income margin?

A good net income margin varies by industry, but generally, a margin of 10% or higher is considered healthy.

18.4. How can I improve my company’s net income?

You can improve your company’s net income by increasing revenue, reducing expenses, and optimizing your business processes.

18.5. What is the role of depreciation in net income calculation?

Depreciation is an expense that reflects the decline in value of assets over time. It is deducted from revenue to calculate net income.

18.6. How do taxes affect net income?

Taxes are a significant expense that reduces net income. Effective tax planning can help minimize tax liabilities and maximize net income.

18.7. Can net income be negative?

Yes, net income can be negative if a company’s expenses exceed its revenue. This is known as a net loss.

18.8. What is the difference between net income and cash flow?

Net income is a measure of profitability, while cash flow is a measure of the actual cash coming into and out of a business.

18.9. How can accounting software help with net income calculation?

Accounting software automates many of the tasks involved in calculating net income, such as tracking revenue and expenses, generating financial statements, and reconciling bank accounts.

18.10. Where can I find help with net income calculation and financial reporting?

You can find help from accountants, financial advisors, and business consultants. income-partners.net can also connect you with experts and resources to support your financial management needs.