Which Are Types Of Income Tax That People Pay? Income tax represents a significant aspect of personal and business finance, influencing both individual wealth and economic strategies. Understanding these types is crucial for making informed financial decisions and optimizing your tax planning strategies with potential partners. At income-partners.net, we help you navigate the complexities of income tax and explore opportunities for strategic partnerships to enhance your financial outcomes. By engaging with us, you gain access to expert insights and a network of professionals dedicated to maximizing your earnings and minimizing tax liabilities, providing comprehensive solutions for wealth management and business collaboration, all while covering areas of tax preparation and understanding tax obligations.

1. Understanding Income Tax: An Overview

Income tax is a mandatory contribution levied by the government on the income of individuals, businesses, and other entities. It’s a primary source of revenue that funds public services like education, infrastructure, and healthcare.

1.1 What Is Income Tax?

Income tax is a levy on taxable income, which includes wages, salaries, profits, and investment gains. The specific types and rates of income tax can vary significantly by jurisdiction, influenced by economic policies and revenue needs. Understanding income tax is essential for anyone looking to manage their finances effectively and explore potential tax-saving opportunities through strategic partnerships.

1.2 Why Is Income Tax Important?

Income tax is important because it enables governments to finance public services and infrastructure, which are vital for economic development and societal well-being. It also plays a role in income redistribution and economic stabilization. For individuals and businesses, understanding income tax obligations and opportunities can lead to better financial planning and growth.

1.3 How Does Income Tax Affect Individuals and Businesses?

Income tax directly affects the disposable income of individuals and the profitability of businesses. It influences spending, investment, and savings decisions. Effective tax planning can mitigate the impact of income tax, enhancing financial stability and growth prospects for both individuals and businesses. At income-partners.net, we offer tailored strategies to optimize your tax position and explore opportunities for strategic alliances that further boost your financial success.

2. Individual Income Tax: Taxes on What You Earn

Individual income tax is a tax levied on the wages, salaries, investments, or other forms of income an individual or household earns. It’s a direct tax, meaning it’s paid directly to the government by the person or entity earning the income.

2.1 Understanding Individual Income Tax

Individual income tax is calculated based on your taxable income, which is your gross income minus certain deductions and exemptions. Tax rates can vary depending on your income level and filing status. According to research from the University of Texas at Austin’s McCombs School of Business, understanding the nuances of individual income tax can significantly impact your financial planning and investment strategies.

2.2 Progressive vs. Regressive Income Tax Systems

Progressive Tax Systems

In a progressive tax system, tax rates increase as income increases. This means higher-income earners pay a larger percentage of their income in taxes than lower-income earners. The U.S. federal income tax system is an example of a progressive system.

Regressive Tax Systems

In a regressive tax system, tax rates decrease as income increases. This means lower-income earners pay a larger percentage of their income in taxes than higher-income earners. Sales taxes can be regressive because lower-income individuals spend a larger portion of their income on goods and services subject to sales tax.

2.3 Tax Brackets and Marginal Tax Rates

Tax brackets are the income ranges to which different tax rates apply. Your marginal tax rate is the rate you pay on the last dollar of income you earn. For example, if you’re in the 22% tax bracket, you’ll pay 22 cents in taxes for every additional dollar you earn within that bracket.

2.3.1 Example of Tax Brackets

The 2020 tax brackets are:

| Rate | For Single Individuals, Taxable Income Over | For Married Individuals Filing Joint Returns, Taxable Income Over | For Heads of Households, Taxable Income Over |

|---|---|---|---|

| 10% | $0 | $0 | $0 |

| 12% | $9,875 | $19,750 | $14,100 |

| 22% | $40,125 | $80,250 | $53,700 |

| 24% | $85,525 | $171,050 | $85,500 |

| 32% | $163,300 | $326,600 | $163,300 |

| 35% | $207,350 | $414,700 | $207,350 |

| 37% | $518,400 | $622,050 | $518,400 |

This structured approach helps in calculating taxes efficiently, crucial for strategic financial collaborations. At income-partners.net, we emphasize these precise calculations to optimize financial partnerships and enhance overall profitability.

2.4 Deductions and Exemptions

Deductions and exemptions reduce your taxable income, which lowers your tax liability. Common deductions include those for mortgage interest, student loan interest, and charitable contributions. Exemptions are amounts you can subtract from your income for yourself, your spouse, and any dependents.

3. Corporate Income Tax: Levies on Business Profits

Corporate income tax (CIT) is a tax levied on the profits of C corporations. It is a significant source of government revenue and affects business investment and growth.

3.1 How Corporate Income Tax Works

Corporate income tax is calculated on a company’s taxable income, which is its revenue minus allowable deductions. The tax rate can be flat or progressive, depending on the jurisdiction.

3.2 Impact of Corporate Income Tax on Businesses

Corporate income tax affects a company’s profitability and its ability to invest in growth opportunities. High corporate tax rates can discourage investment and reduce competitiveness, while low rates can stimulate economic activity.

3.3 Pass-Through Entities vs. C Corporations

Pass-Through Entities

Pass-through entities, such as partnerships, S corporations, and LLCs, are not subject to corporate income tax. Instead, their income is passed through to the owners, who pay individual income tax on their share of the profits.

C Corporations

C corporations are subject to corporate income tax on their profits. However, their shareholders also pay individual income tax on any dividends they receive, which can result in double taxation.

3.4 Corporate Tax Rates Around the World

Corporate tax rates vary significantly around the world. Some countries have very low corporate tax rates to attract foreign investment, while others have higher rates to fund public services.

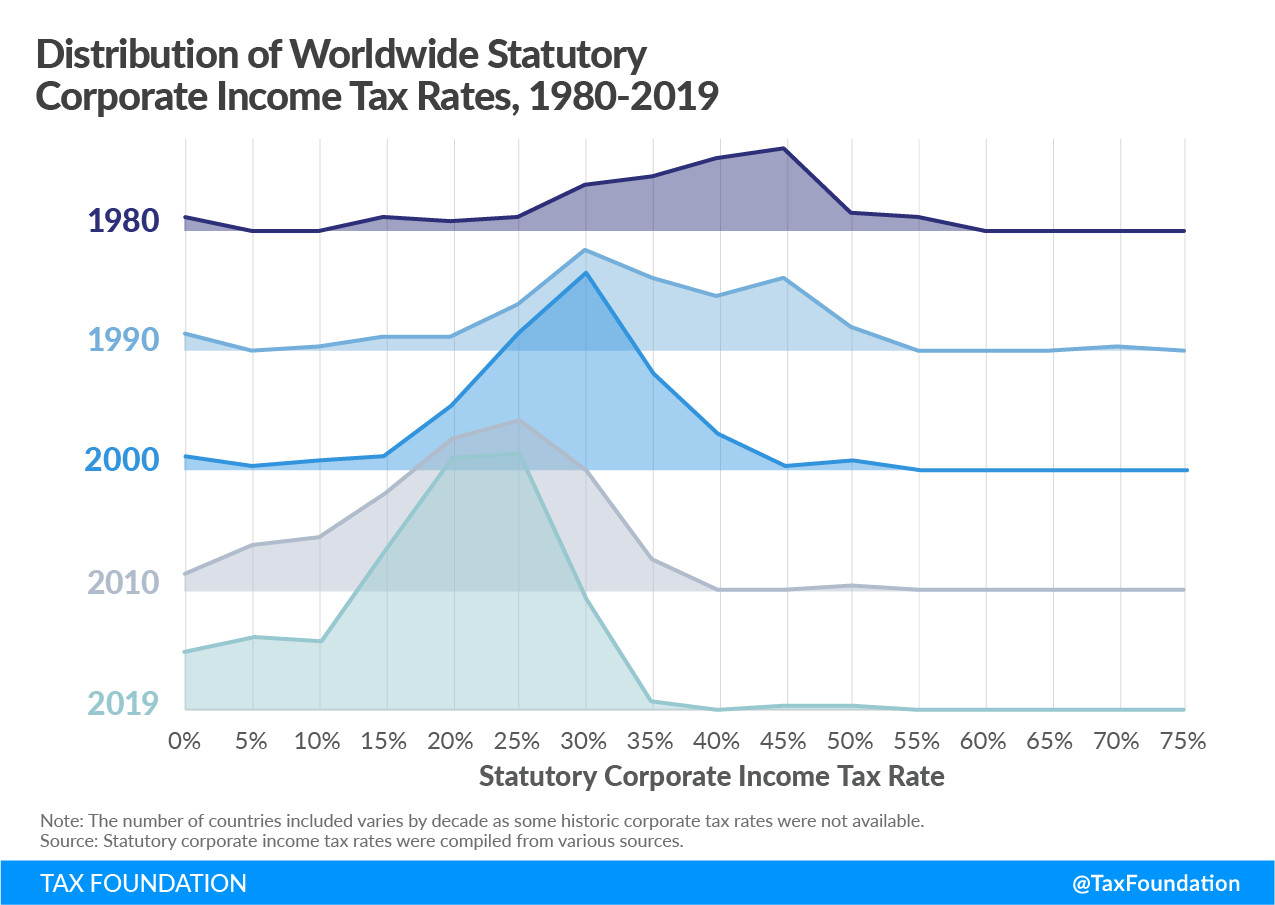

Distribution of worldwide statutory corporate income tax rates, 1980-2019

Distribution of worldwide statutory corporate income tax rates, 1980-2019

The distribution of worldwide statutory corporate income tax rates from 1980-2019 shows the continuous variation of tax rates that influence global business strategies and investment choices. A thorough understanding of these rates helps in creating effective partnerships that address international tax implications, which is a key focus at income-partners.net for fostering successful global business relationships.

4. Payroll Taxes: Funding Social Insurance Programs

Payroll taxes are taxes paid on the wages and salaries of employees to finance social insurance programs like Social Security and Medicare.

4.1 Understanding Payroll Taxes

Payroll taxes are typically split between employers and employees. In the U.S., the largest payroll taxes are for Social Security and Medicare, totaling 15.3% of wages, with half paid by the employer and half by the employee.

4.2 Social Security and Medicare Taxes

Social Security Tax

Social Security tax is a 12.4% tax on earnings up to a certain annual limit. It funds retirement, disability, and survivor benefits.

Medicare Tax

Medicare tax is a 2.9% tax on all earnings. It funds healthcare benefits for seniors and people with disabilities.

4.3 Employer vs. Employee Responsibilities

Employers are responsible for withholding and remitting payroll taxes to the government. They also pay a portion of the payroll taxes themselves. Employees see their share of payroll taxes deducted from their paychecks.

4.4 Impact on Employers and Employees

Payroll taxes can affect hiring decisions and employee compensation. High payroll taxes can increase labor costs for employers, while reducing take-home pay for employees.

5. Capital Gains Taxes: Taxing Investment Profits

Capital gains tax is a tax on the profit made from selling an asset, such as stocks, bonds, or real estate.

5.1 How Capital Gains Tax Works

Capital gains tax is paid when you sell an asset for more than you paid for it. The difference between the purchase price and the sale price is your capital gain.

5.2 Short-Term vs. Long-Term Capital Gains

Short-Term Capital Gains

Short-term capital gains are profits from assets held for one year or less. They are taxed at your ordinary income tax rate.

Long-Term Capital Gains

Long-term capital gains are profits from assets held for more than one year. They are taxed at lower rates than ordinary income, with rates of 0%, 15%, or 20% depending on your income level.

5.3 Tax Rates on Capital Gains

The tax rates on capital gains depend on your income level and the length of time you held the asset. Lower-income individuals may pay no capital gains tax, while higher-income individuals may pay up to 20%.

5.4 Impact on Investment Decisions

Capital gains taxes can influence investment decisions, encouraging investors to hold assets for longer periods to qualify for lower tax rates.

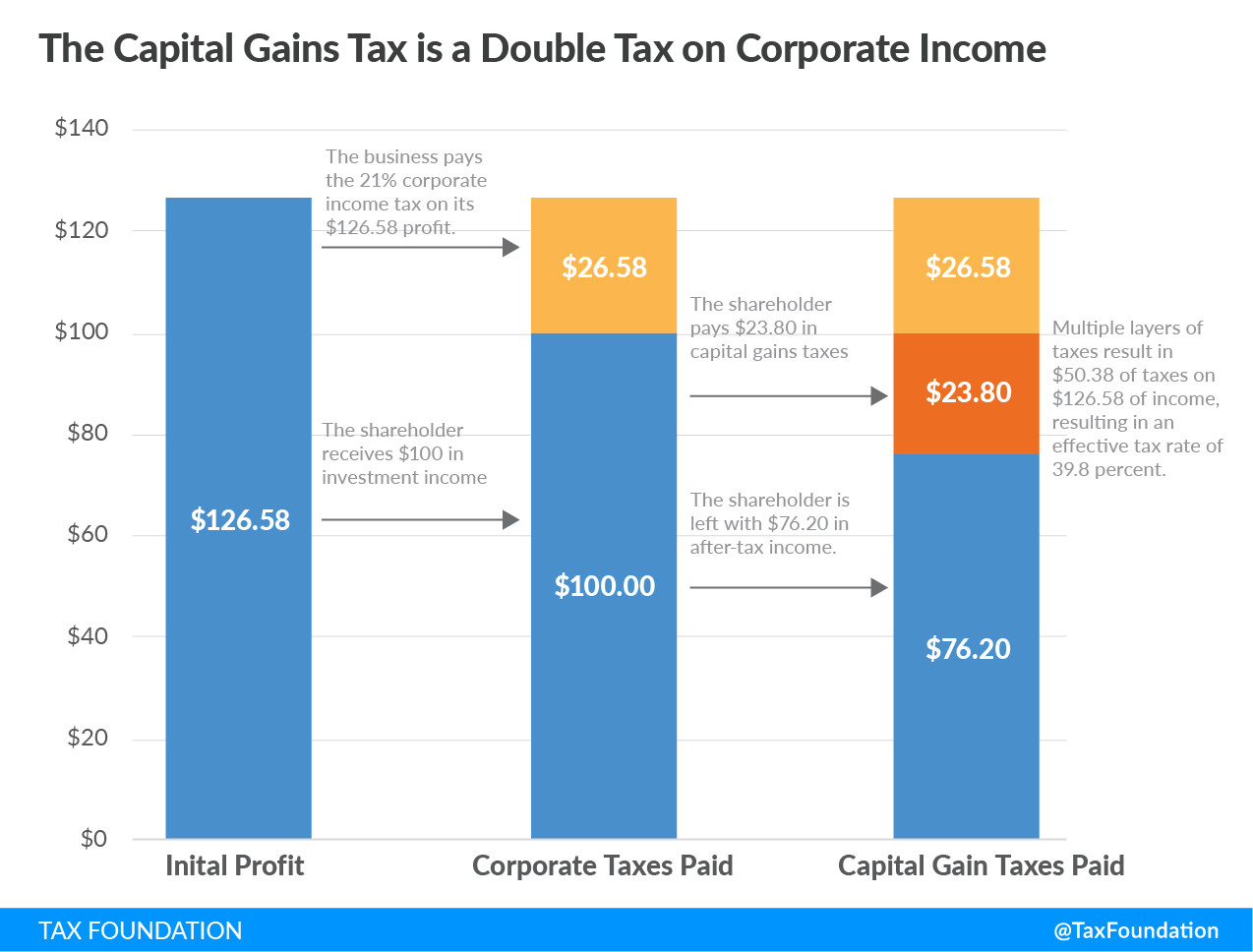

The capital gains tax is a double tax on corporate income

The capital gains tax is a double tax on corporate income

The diagram illustrates how capital gains tax can lead to double taxation on corporate income, which affects investment returns. Addressing this issue through strategic tax planning is vital for maximizing financial benefits in business collaborations. At income-partners.net, we provide expert advice to handle these tax implications efficiently, improving partnership outcomes.

6. Sales Taxes: Levied on Retail Sales

Sales taxes are a form of consumption tax levied on the retail sales of goods and services. This tax is generally added to the price of the product or service at the point of purchase.

6.1 Understanding Sales Taxes

Sales taxes are calculated as a percentage of the sale price and are collected by the seller, who then remits them to the government. These taxes are a significant source of revenue for state and local governments in the U.S.

6.2 Sales Tax Rates and Bases

Sales tax rates vary by state and locality. The sales tax base, which is the set of goods and services subject to sales tax, also varies.

6.3 Exemptions and Common Sales Tax Rules

Exemptions

Many states exempt certain items from sales tax, such as groceries, prescription drugs, and clothing. These exemptions are intended to reduce the tax burden on essential goods.

Sales Tax Rules

Sales tax rules can be complex, particularly for businesses that operate in multiple states. Nexus, which is a connection to a state that requires a business to collect sales tax, can be created by having a physical presence, employees, or affiliates in a state.

6.4 Impact on Consumers and Businesses

Sales taxes increase the cost of goods and services for consumers. They can also create administrative burdens for businesses, which must collect and remit the tax.

7. Gross Receipts Taxes: Taxes on Gross Sales

Gross receipts taxes (GRTs) are taxes applied to a company’s gross sales, regardless of profitability and without deductions for business expenses.

7.1 Understanding Gross Receipts Taxes

Gross receipts taxes are imposed at each stage in the production chain, leading to tax pyramiding.

7.2 How Gross Receipts Taxes Work

GRTs are calculated as a percentage of a company’s gross receipts, without any deductions for costs or expenses.

7.3 Advantages and Disadvantages of GRTs

Advantages

GRTs are relatively simple to administer and can generate a stable source of revenue for governments.

Disadvantages

GRTs can be harmful for startups and businesses with long production chains. They can also distort business decisions and reduce competitiveness.

7.4 Examples of States with GRTs

Several states in the U.S. have gross receipts taxes, including Delaware, Nevada, Ohio, and Washington.

8. Value-Added Taxes (VAT): Consumption Tax on Value Added

A Value-Added Tax (VAT) is a consumption tax assessed on the value added in each production stage of a good or service.

8.1 Understanding Value-Added Taxes

A VAT is levied on the difference between a business’s sales and its purchases of inputs. The final consumer pays the VAT without being able to deduct the previously paid VAT, making it a tax on final consumption.

8.2 How VAT Works

Each business along the production chain is required to pay a VAT on the value of the produced good/service at that stage, with the VAT previously paid for that good/service being deductible at each step.

8.3 VAT Rates Around the World

More than 140 countries worldwide and all OECD countries except the United States levy a VAT. Standard VAT rates range from 15% to 25%.

8.4 Impact on Businesses and Consumers

VAT can affect business decisions and consumer prices. It can also be a significant source of revenue for governments.

9. Excise Taxes: Taxes on Specific Goods or Activities

Excise taxes are taxes imposed on a specific good or activity, usually in addition to a broad consumption tax.

9.1 Understanding Excise Taxes

Excise taxes are typically levied on goods that are considered harmful, such as cigarettes, alcohol, and gasoline.

9.2 Common Examples of Excise Taxes

Common examples of excise taxes include those on cigarettes, alcohol, soda, gasoline, and betting.

9.3 Sin Taxes and User Fees

Sin Taxes

Excise taxes can be employed as “sin” taxes, to offset externalities. For instance, governments may place a special tax on cigarettes in hopes of reducing consumption and associated health-care costs, or an additional tax on carbon to curb pollution.

User Fees

Excise taxes can also be employed as user fees. A good example of this is the gas tax. The amount of gas a driver purchases generally reflects their contribution to traffic congestion and road wear-and-tear. Taxing this purchase effectively puts a price on using public roads.

9.4 Impact on Consumer Behavior

Excise taxes can influence consumer behavior, discouraging the consumption of taxed goods.

10. Property Taxes: Levied on Immovable Property

Property taxes are primarily levied on immovable property like land and buildings and are an essential source of revenue for state and local governments in the U.S.

10.1 Understanding Property Taxes

Property taxes are typically based on the assessed value of the property and are used to fund local services like schools, roads, and police.

10.2 How Property Taxes Work

Property taxes are calculated by multiplying the assessed value of the property by the local tax rate.

10.3 Impact on Homeowners and Businesses

Property taxes can affect the affordability of homeownership and the cost of doing business.

10.4 Real vs. Tangible Personal Property Taxes

Real Property Taxes

Real property taxes are levied on land and buildings.

Tangible Personal Property Taxes

Tangible personal property (TPP) is property that can be moved or touched, such as business equipment, machinery, inventory, furniture, and automobiles.

11. Tangible Personal Property (TPP) Taxes: Taxes on Movable Property

Tangible personal property (TPP) is property that can be moved or touched, such as business equipment, machinery, inventory, furniture, and automobiles.

11.1 Understanding TPP Taxes

Taxes on TPP make up a small share of total state and local tax collections but are complex, creating high compliance costs; are nonneutral, favoring some industries over others; and distort investment decisions.

11.2 How TPP Taxes Work

TPP taxes are typically based on the assessed value of the property and are used to fund local services.

11.3 Impact on Businesses

TPP taxes place a burden on many of the assets businesses use to grow and become more productive, such as machinery and equipment. By making ownership of these assets more expensive, TPP taxes discourage new investment and have a negative impact on economic growth overall.

11.4 States That Tax TPP

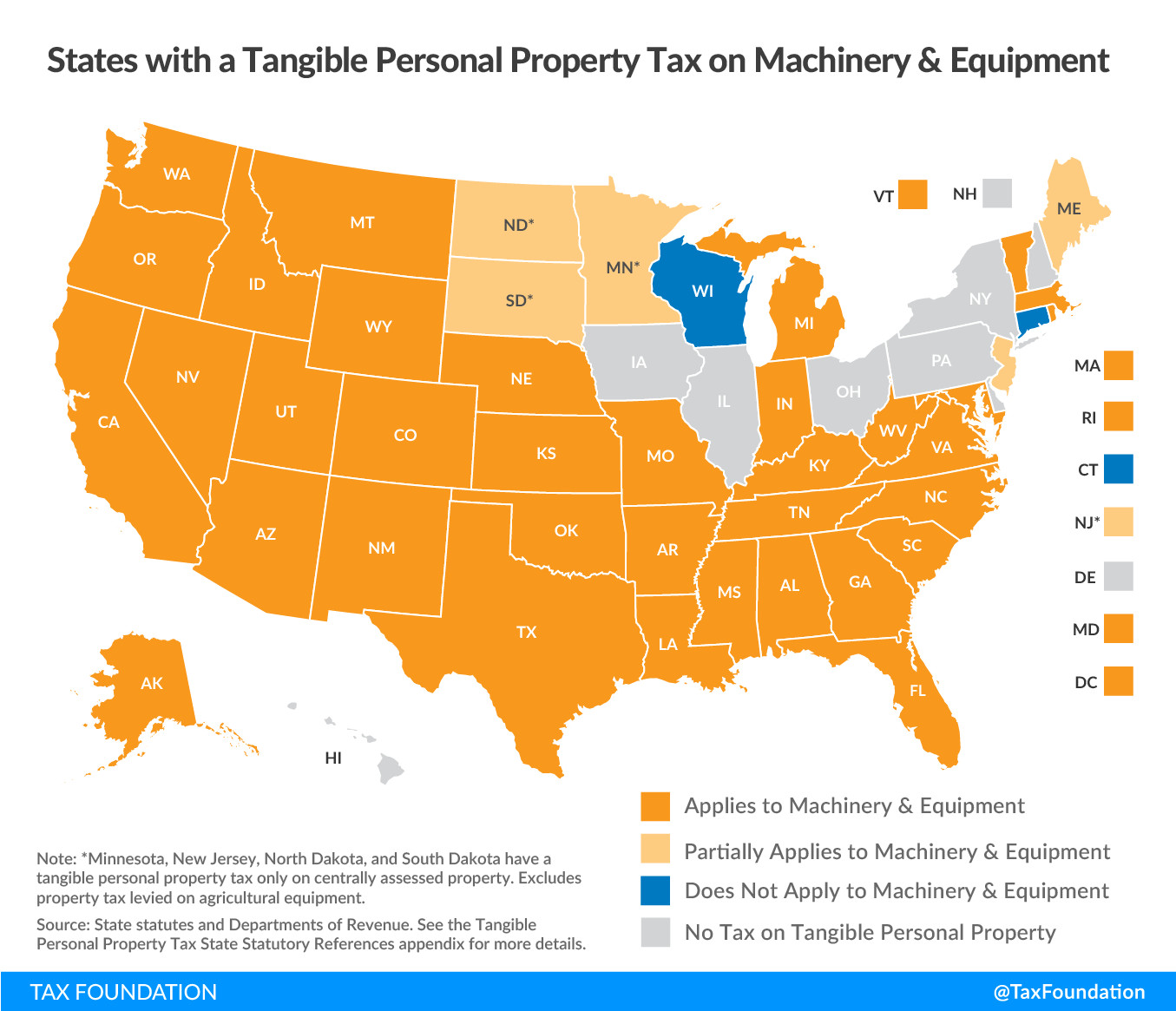

As of 2019, 43 states taxed tangible personal property.

tangible personal property tax liability, state tangible personal property taxes

tangible personal property tax liability, state tangible personal property taxes

This visual represents the tangible personal property tax liability across different states, highlighting the tax’s burden on business assets. Strategic partnerships that aim to optimize asset utilization and minimize tax liabilities are essential. At income-partners.net, we specialize in creating collaborations that take advantage of varying state tax laws to enhance overall financial performance.

12. Estate and Inheritance Taxes: Taxes on Transferred Property at Death

Both estate and inheritance taxes are imposed on the value of an individual’s property at the time of their death.

12.1 Understanding Estate and Inheritance Taxes

While estate taxes are paid by the estate itself, before assets are distributed to heirs, inheritance taxes are paid by those who inherit property.

12.2 How Estate and Inheritance Taxes Work

Estate and inheritance taxes are typically based on the value of the property transferred at death.

12.3 Impact on Heirs and Estates

Estate and inheritance taxes can reduce the amount of wealth that is transferred to heirs.

12.4 Gift Taxes

Both taxes are usually paired with a “gift tax” so that they cannot be avoided by transferring the property prior to death.

13. Wealth Taxes: Taxes on Net Wealth

Wealth taxes are typically imposed annually on an individual’s net wealth (total assets, minus any debts owed) above a certain threshold.

13.1 Understanding Wealth Taxes

Wealth taxes are typically imposed annually on an individual’s net wealth (total assets, minus any debts owed) above a certain threshold.

13.2 How Wealth Taxes Work

Wealth taxes are calculated by multiplying an individual’s net wealth above a certain threshold by the tax rate.

13.3 Impact on High-Net-Worth Individuals

Wealth taxes can reduce the wealth of high-net-worth individuals.

13.4 Countries with Wealth Taxes

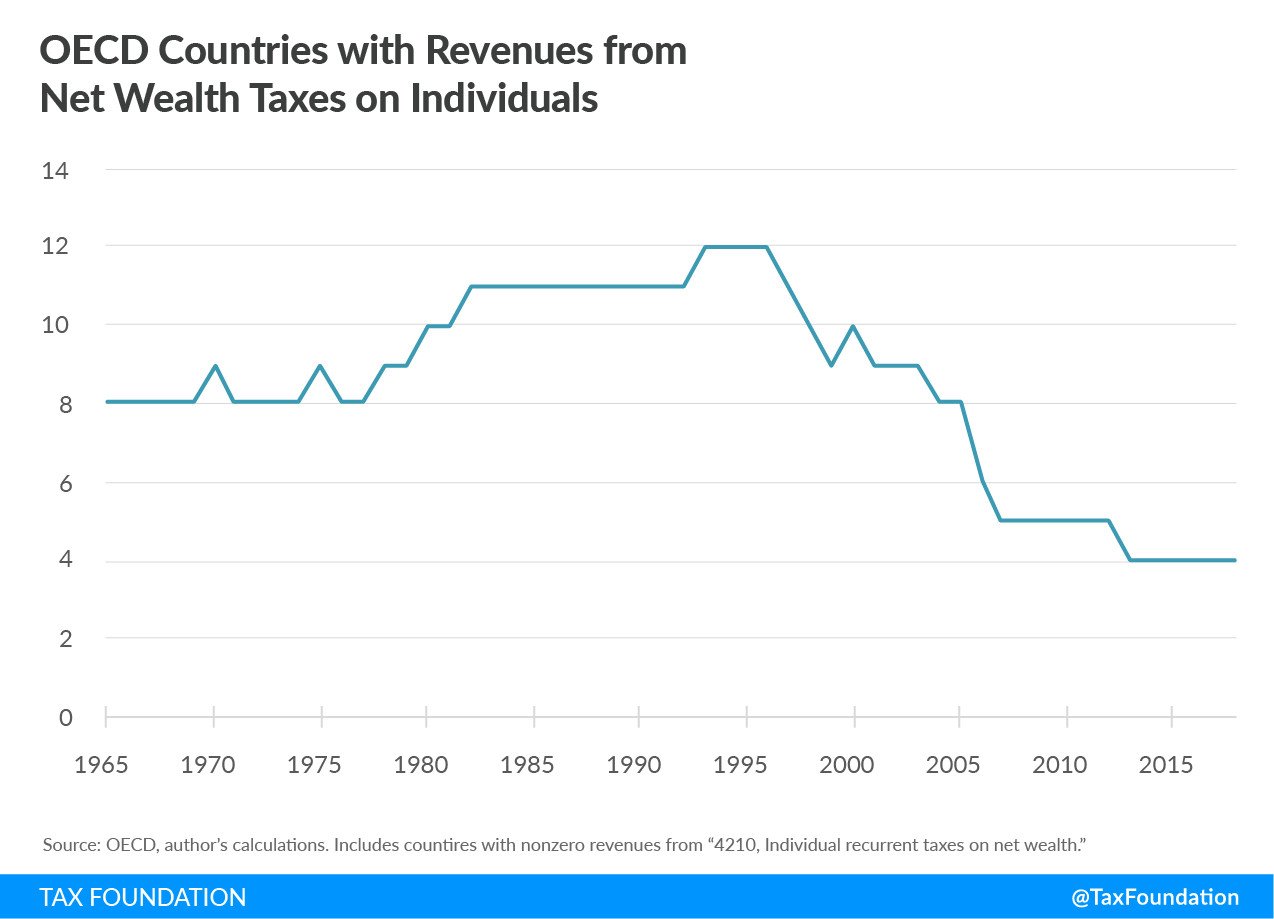

As of 2019, only six countries in Europe—Norway, Spain, Switzerland, Belgium, the Netherlands, and Italy—had a wealth tax.

OECD-Net-Wealth-Tax-Revenue

OECD-Net-Wealth-Tax-Revenue

The chart displays the net wealth tax revenue in OECD countries, illustrating the fiscal impact and prevalence of wealth taxes. Partnerships that strategically manage wealth and navigate international tax laws are vital for high-net-worth individuals. Income-partners.net provides access to experts who can optimize financial collaborations in light of global tax obligations.

14. Key Takeaways on Different Types of Income Tax

Understanding the different types of income tax is crucial for effective financial planning and wealth management. Each type of tax has its own unique rules and impacts, which can affect individuals and businesses differently.

14.1 Summary of Tax Types

| Tax Type | Description | Impact |

|---|---|---|

| Individual Income Tax | Tax on wages, salaries, and investment income | Affects disposable income and investment decisions |

| Corporate Income Tax | Tax on business profits | Affects profitability and investment in growth |

| Payroll Taxes | Taxes on wages to fund social insurance programs | Affects hiring decisions and employee compensation |

| Capital Gains Taxes | Tax on profits from selling assets | Influences investment decisions |

| Sales Taxes | Tax on retail sales of goods and services | Increases the cost of goods for consumers |

| Gross Receipts Taxes | Tax on a company’s gross sales | Can be harmful for startups and businesses with long production chains |

| Value-Added Taxes (VAT) | Consumption tax on value added in each production stage | Affects business decisions and consumer prices |

| Excise Taxes | Tax on specific goods or activities | Influences consumer behavior |

| Property Taxes | Tax on immovable property like land and buildings | Affects the affordability of homeownership and the cost of doing business |

| Tangible Personal Property (TPP) Taxes | Tax on movable property like business equipment | Discourages new investment and has a negative impact on economic growth |

| Estate and Inheritance Taxes | Tax on the value of an individual’s property at the time of their death | Can reduce the amount of wealth that is transferred to heirs |

| Wealth Taxes | Tax on an individual’s net wealth | Can reduce the wealth of high-net-worth individuals |

14.2 How to Minimize Your Tax Liability

There are several strategies you can use to minimize your tax liability, including:

- Taking advantage of deductions and exemptions

- Investing in tax-advantaged accounts

- Planning your investment sales to minimize capital gains taxes

14.3 The Role of Strategic Partnerships in Tax Planning

Strategic partnerships can play a crucial role in tax planning by providing access to expertise and resources that can help you optimize your tax position. By working with partners who have specialized knowledge of tax law and financial planning, you can develop strategies that minimize your tax liability and maximize your wealth.

15. FAQs About Types of Income Tax

15.1 What is the difference between income tax and payroll tax?

Income tax is levied on various forms of income, including wages, salaries, and investment gains, while payroll tax specifically funds social insurance programs like Social Security and Medicare.

15.2 How do tax brackets work?

Tax brackets are income ranges to which different tax rates apply. Your marginal tax rate is the rate you pay on the last dollar of income you earn.

15.3 What are some common tax deductions?

Common tax deductions include those for mortgage interest, student loan interest, and charitable contributions.

15.4 How does capital gains tax affect my investments?

Capital gains tax is paid when you sell an asset for more than you paid for it. The tax rate depends on how long you held the asset.

15.5 What is a value-added tax (VAT)?

A VAT is a consumption tax assessed on the value added in each production stage of a good or service.

15.6 What are excise taxes?

Excise taxes are taxes imposed on specific goods or activities, usually in addition to a broad consumption tax.

15.7 How are property taxes calculated?

Property taxes are calculated by multiplying the assessed value of the property by the local tax rate.

15.8 What are estate and inheritance taxes?

Estate and inheritance taxes are imposed on the value of an individual’s property at the time of their death.

15.9 What is a wealth tax?

A wealth tax is typically imposed annually on an individual’s net wealth above a certain threshold.

15.10 How can strategic partnerships help with tax planning?

Strategic partnerships can provide access to expertise and resources that can help you optimize your tax position and minimize your tax liability.

16. Discover Partnership Opportunities at Income-Partners.net

Ready to take your financial planning to the next level? At income-partners.net, we offer a wealth of resources and opportunities to help you connect with strategic partners who can enhance your income and minimize your tax liabilities. Explore our platform today to discover:

- Diverse Partnership Options: Find the types of business partnerships that align with your financial goals, from strategic alliances to joint ventures.

- Expert Insights: Access articles, guides, and expert advice on tax planning, wealth management, and partnership strategies.

- Networking Opportunities: Connect with other professionals and entrepreneurs in the U.S. to explore potential collaboration opportunities.

Visit income-partners.net today and start building the partnerships that will drive your financial success. For more information or assistance, contact us at:

- Address: 1 University Station, Austin, TX 78712, United States

- Phone: +1 (512) 471-3434

- Website: income-partners.net

Begin your journey towards financial prosperity and strategic growth with income-partners.net. Unlock the power of collaboration and transform your financial future today.